Abstract

Study design: A population-based study utilizing a difference-in-differences (DD) estimation strategy.

Objectives: To examine if anti-obesity legislation, specifically, menu labeling laws, snack taxes and Complete Streets policy effectively reduce rates of adult obesity.

Background: State legislatures have enacted laws in an attempt to reduce rates of adult obesity. These state policies need to be evaluated on their impact on altering BMI at the level of the individual. Further, the impact of these anti-obesity policies must be evaluated to determine best practices for future policy interventions.

Methods/Measures: Using data from the Behavioral Risk Factor Surveillance System (BRFSS), Bureau of Economic Analysis (BEA), and Census, state panel datasets inclusive of all 50 states and the District of Columbia were compiled for adults 18 years of age and older, for the time period of 1995 to 2011. Time series regression analysis was completed to evaluate the policies at a state, group and individual level. Multiple years of data were analyzed to control for any underlying secular changes occurring within states that might have accounted for the rates of adult obesity. Mechanically, the DD models regressed adult obesity rate and (body mass index) BMI on year indicator variables interacted with an indicator variable for whether the state implemented an anti-obesity policy along with a rich set of socio-demographic controls and state and year fixed effects.

Results: At the state level, menu labeling was associated with a 0.85% reduction in rate of adult obesity (p=0.09) and snack taxes were associated with a 0.53% decrease (p=0.02). At the individual level, menu labeling was associated with a 0.16% decrease in BMI (p=0.05). At the group level, statistical significance of menu labeling and snack taxes on reducing BMI varied by age, income, education, race and gender. Complete Streets policy was not statistically significant in altering adult obesity rates at the state level or BMI at the individual or group level.

Conclusions: Although, the magnitude of effect of menu labeling and snack taxes was small, these policies are associated with a reduction in adult obesity rates at the state level and BMI at the individual level. This study has implications for future policy interventions aimed at addressing adult obesity. The results of this study highlight how a “one size fits all approach” will not be effective in combating the obesity epidemic, rather an assortment of legislative policies are necessary. Further, based on the reduction in both aggregated rates of adult obesity and BMI at the individual level, menu labeling policy warrants further attention.

Key words

obesity, public policy

Introduction

Obesity epidemic

The prevalence of adult obesity has reached epidemic levels in the United States. Current reports indicate more than one-third of all adults are obese [1,2]. Increases in rates of adult obesity have occurred across all ages, racial and ethnic groups, as well as for both genders. Obesity is a major public health concern for the U.S., as corpulence is associated with significant consequences for both the individual and society [3].

Obese adults are at increased risk for a variety of chronic health issues such as coronary heart disease, type 2 diabetes mellitus, and cancer [4,5]. Chronic excess body fatness is also associated with early mortality. Approximately 14 percent of all premature deaths per year in the U.S. are related to obesity [6]. As the prevalence of obesity increases, life expectancy rates are predicted to decline for the first time since the Great Depression [7,8].

Obesity is a significant burden on the U.S. economy in the form of direct and indirect costs [9]. Direct costs of obesity stem from associated medical expenditures including physician office visits, hospitalizations, and emergency department visits. Obese individuals have an overall higher utilization rate of healthcare services with longer hospitalization stays and increased rates of physician and emergency department visits compared to their normal weight peers [10,11]. Estimates indicate obese patients have an average length of hospital stay of 4 days longer and a cross-sectional study of employees in the U.S. found obese employees had a 26% higher rate of emergency department visits [10,12]. In 2000, the total healthcare cost of obesity in the U.S. was roughly $117 billion and in 2008, this cost had grown to $147 billion [1,13]. If obesity trends continue, the prevalence of adult obesity will approach 100% and health care costs stemming from obesity will double every decade [14].

Indirect costs of obesity are largely associated with a loss of wages due to poor work productivity [9,15]. Ricci and Chee [16] found a statistically significant reduction in productive work time for obese workers compared to normal weight individuals. The cost of lost productivity associated with obesity was recently estimated at 3.9 billion dollars [17].

The rising rates of obesity over the past decade have not gone unnoticed by policy makers. Several state legislatures have enacted laws in an attempt to curtail rising rates of adult obesity. Recent enacted policies include: menu labeling laws, snack taxes, and Complete Streets policy [18].

Conceptual model for obesity prevention

Early models of obesity intervention emphasized behavioral treatments at the individual level. Exclusively focusing treatment at the person level neglected the powerful influence physical and social context has on the structure of behavior [19-21]. These naïve intervention models have been relatively ineffective as obesity rates have continued to escalate over the past several decades [21-25].

Recently, the application of a social ecological model has been promoted for obesity intervention. The social ecological model is based on the concept that health behaviors are influenced by factors at multiple levels such as the individual, interpersonal, organizational, community, and societal level [26-28]. In particular, this model recognizes how social, environmental and policy characteristics influence health behaviors at the individual and societal level [30,31]. Evidence supports a person’s environmental situation influences eating and exercise habits [29,31-34]. Experts have determined effective obesity intervention strategies will require changes to the environment in which people live [25,29,35]. In order for individuals to make healthy lifestyle choices, an environment consisting of political, social and economic support for healthy living must be constructed [28,34].

The widespread prevalence of obesity across all populations indicates individualized intervention strategies are an unsustainable approach for curtailing the obesity epidemic. It would simply be too costly and too difficult to directly reach each individual person for obesity screening and treatment [29]. Population-based strategies designed to alter food choices and activity patterns on a large-scale platform can reach larger audiences at a lower cost per person [29]. The Centers for Disease Control and Prevention (CDC) currently recommends a public health policy model would be more reasonable and more effective in minimizing the expanding burden of obesity [22,36].

State legislators have responded to the CDC’s recommendation by implementing policies aimed to address the obesity epidemic.

Obesity legislation

Menu labeling

In an effort to improve consumer nutritional awareness, several states have enacted laws mandating chain restaurants, defined as restaurants with more than 20 locations, provide nutrition information on both menus and menu boards [18]. Menu labeling requires information related to total amount of calories for both food and beverage items be disclosed with the information formatted clearly and conspicuously. Menu labeling has been enacted in five states: California (2008), Maine (2009), Massachusetts (2009), New Jersey (2010), and Oregon (2009) [18,37].

Snack taxes

Founded in economic theory, some states have implemented snack taxes on foods considered to have low nutritional value with the expectation that higher cost will deter consumers from purchasing these food items [18]. Twenty states and the District of Columbia have implemented snack tax laws. The following is a list of states with snack tax laws: California (2009), Colorado (2010), Connecticut (1988), D.C. (1993, repealed in 2000), Florida (1999), Illinois (2009), Indiana (2004), Iowa (2004), Kentucky (2004), Maine (1991, repealed in 1999), Maryland (1997), Minnesota (2009), Mississippi (2004), New Jersey (2005), New York (1987), North Carolina (2008), North Dakota (2007), Rhode Island (2007), Texas (2003), West Virginia (2008), and Wisconsin (2009) [20]. The following is a list of the type of snack foods taxed: candy, chips, pretzels, ice cream, popsicles, and baked goods [38,39].

Complete streets policy

To improve opportunities for individuals to engage in physical activity within their community environment, some states have adopted Complete Streets Policy. Complete Streets policy is intended to formalize a communities “intent to plan, design, operate and maintain streets” ([40], p. 9) to be safe and usable for all individuals. Following the guidelines set forth in Complete Streets policy, 22 states have enacted legislation to improve the availability of biking and walking trails to promote healthy community designs and increase safe opportunities for residents to participate in physical activity. These states are: California (2008), Colorado (2009), Connecticut (2009), Delaware (2009), Florida (1984), Hawaii (2009), Illinois (2007), Louisiana (2010), Maryland (2000), Massachusetts (2006), Michigan (2010), Minnesota (2010), Mississippi (2010), New Jersey (2009), North Carolina (2009), Oregon (1971), Pennsylvania (2007), Rhode Island (1997), South Carolina (2003), Tennessee (2010), Virginia (2004), and Wisconsin (2008) [41].

The impact of these state legislative policies (menu labeling, snack taxes and Complete Streets policy) on slowing rates of adult obesity within states with these policies has not been studied; therefore, their effect is currently unknown. The aim of my research was to evaluate the effectiveness of existing obesity legislation on altering individual BMI.

Methods

Design

In this study, I employed a difference-in-differences (DD) research design model to evaluate the impact of anti-obesity legislation. I investigated whether states adopting various anti-obesity policies saw different rates of growth in obesity rates than observationally equivalent states over the same time period. Multiple years of data were analyzed to control for any underlying secular changes occurring within states that might have accounted for the rates of adult obesity.

Data sets

Several panel data sets were constructed inclusive of all 50 states and the District of Columbia. Panel data sets included: an aggregated state level data set, an individual level data set and group level data sets. The individual data set was used to generate the group level datasets; race, age, income, education and gender groups were created.

For the aggregated state level data set, the dependent variable was the percentage of obese adults. The covariates were: age, gender, race, healthcare coverage, tobacco use, education, state population, per capita income and employment to population ratio. The data set included dummy variables for each of the anti-obesity policies, including menu labeling, snack taxes, and Complete Streets. The dummy variables were coded to indicate which states for which years had these laws in affect.

For the individual and group level data sets, the dependent variable was BMI. The covariates were: age, gender, race, healthcare coverage, tobacco use, education level, and income level. The individual and group level data sets also included dummy variables for each of the anti-obesity policies with these variables coded for the years the laws were in effect.

Data sources

Data for this project was retrieved from the Centers for Disease Control and Prevention (CDC) via the Behavioral Risk Factor Surveillance System (BRFSS). The BRFSS is a state-based cross-sectional telephone health survey collecting data on adults 18 years of age and older. Data collected from the BRFSS is published on a yearly basis.

For the analysis of aggregated state level data, the following information was obtained from the BRFSS: adult obesity rate by state, the demographic composition of each state (age, gender, and race), percentage of individuals with healthcare coverage per state, percentage tobacco users and percentage of adults with a high school education or equivalent (GED) by state. Inclusion of data on state demographics as well state composition for health insured, tobacco users and high school graduates was to account for differences in each state’s population mix, which might influence variability in rates of obesity between states.

State level data by year for average per capita income and employment to population ratio was retrieved from the U.S. Department of Commerce, Bureau of Economic Analysis. State level data by year for total population was obtained from the U.S. Census Bureau. These covariates were incorporated into the state level analysis to account for differences in state size and income that might influence differences observed in obesity rates between states.

For the individual and group level analysis, the following individual level data was obtained from the BRFSS: BMI, age, gender, race, healthcare coverage, tobacco use, education level, and income level.

The BRFSS uses body mass index (BMI) to measure adult obesity. The BRFSS classifies BMI into four categories, underweight, normal, overweight and obese. The categories are divided according to guidelines established by the CDC. A BMI between 12.0 and 18.4 is considered underweight, BMI between 18.5 and 24.9 kg/m2 is defined as normal, BMI between 25.0 and 29.9 kg/m2 is considered overweight and BMI between 30.0 and 99.8 kg/m2 is categorized as obese (CDC, 2012).

The BRFSS use subgroups for race, age, income and education data. For the data sets, four categories were used for race/ethnicity (Non-Hispanic White, African American, Hispanic, Other). Six categories were used for age (age 18-24, age 25-34, age 35-44, age 45-54, age 55-64 and age 65). Eight categories were used for income (<10,000, 10,000-14,999, 15,000-19,999, 20,000-24,999, 25,000-34,999, 35,000-49,999, 50,000-74,999, and >75,000) and six categories were used for education (no school, grades 1-8, grades 9-11, high school graduate, college 1-3 and college graduate).

The time period for all of the panel data sets was from 1995 to 2011. Obesity data via the BRFSS was first available for all states in 1995 and the most recent available data is up to the year 2011. The other covariates are collected every year as part of the BRFSS. The purpose of having a 16-year timeframe for the panel datasets was to be able to determine obesity rates and BMI values for several years prior to and post the implementation of the obesity related legislation.

Table 1 identifies each of the study variables by name for the state level data analysis, the nomenclature for each variable as expressed in the regression models, the conceptual definition for each variable, how each variable was coded for use in the state level panel dataset and each variables data-source.

The quantitative variables for the individual and group level analysis were the same as the variables listed in Table 1, with the exception of the dependent variable, which was BMI.

Table 1. Quantitative Variables, State Level Analysis

Variable Name |

Conceptual Definition |

Operational Definition |

Percentage adult |

Degree of adult obesity by |

The percentage of adults with BMI between 30.0 and 99.8 |

obesity (dependent |

state per year |

in year XXXX |

variable) for state |

|

|

level data |

|

|

Menu labeling |

If a state had a menu |

0 = state did not have a menu labeling law in year xxxx |

|

labeling law in effect |

1 = state did have a menu labeling law in year XXXX |

Snack Tax |

If a state had a snack tax |

0 = state did not have a snack tax policy in year xxxx |

|

law in effect |

1 = state did have a snack tax policy in year XXXX |

|

|

|

Complete Streets |

If a state had a Complete |

0 = state did not have a Complete Streets policy in year |

|

Streets policy in effect |

XXXX |

|

|

1 = state did have a Complete Streets policy in year |

|

|

XXXX |

Age |

Age composition of state |

A1= % adults aged 18-24 |

|

population by state per |

A2= % adults aged 25-34 |

|

year |

A3= % adults aged 35-44 |

|

|

A4= % adults aged 45-54 |

|

|

A5= % adults aged 55-64 |

|

|

A6= % adults aged 65+ |

Gender |

Gender composition by |

G1 = the percentage of males by state in year XXXX |

|

state per year |

G2 = the percentage of females by state in year XXXX |

|

|

|

Race |

Racial composition of |

R1= % Non-Hispanic White |

|

state population by state |

R2= % African American |

|

per year |

R3= % Hispanic |

|

|

R4= Other |

Health Coverage |

Number of individuals |

The percentage of adults aged 18-64 who have any kind of |

|

with health care insurance |

health insurance coverage by state in year XXXX |

|

by state per year |

|

Tobacco Use |

State composition of |

The percentage of adults who are current smokers by state |

|

tobacco users by state per |

in year XXXX |

|

year |

|

Education |

Number of individuals |

The percentage of adults with a high school degree or |

|

with a high school degree |

GED by state in year XXXX |

|

or GED by state per year |

|

State Population |

Population size by state in |

Total population for state in year XXXX |

|

a particular year |

|

Per capita income |

Financial viability of state |

Mean income for state in year XXXX |

|

in particular year |

|

Employment to |

Proportion of adults |

Ratio of total working age of labor force currently |

Population Ratio |

employed by state per year |

employed to the total working age population for state in |

|

|

year XXXX |

|

|

|

AMst |

Time period after menu |

0 |

= time period is before menu labeling law in effect |

|

labeling policy in effect |

1 |

= time period is after menu labeling law put in effect |

ASst |

Time period after snack |

0 |

= time period is before snack tax law in effect |

|

tax policy in effect |

1 |

= time period is after snack tax law put in effect |

ACst |

Time period after |

0 |

= time period is before Complete Streets policy in effect |

|

Complete Streets policy in |

1 |

= time period is after Complete Streets policy put in |

|

effect |

effect |

|

|

|

|

Interaction term |

0, 0 = no policy, time period before policy in effect |

MstAMst |

representing state has |

0, 1 = no policy, time period after policy in effect |

|

menu labeling policy and |

1, 0 = state has policy, time period before policy in effect |

|

in time period after policy |

1, 1 = state has policy, time period after policy in effect |

|

in effect |

|

|

|

Interaction term |

0, 0 = no policy, time period before policy in effect |

Sst ASst |

representing state has |

0, 1 = no policy, time period after policy in effect |

|

snack tax policy and in |

1, 0 = state has policy, time period before policy in effect |

|

time period after policy in |

1, 1 = state has policy, time period after policy in effect |

|

effect |

|

|

|

|

|

|

Interaction term |

0, 0 = no policy, time period before policy in effect |

Cst ACst |

representing state has |

0, 1 = no policy, time period after policy in effect |

|

Complete Streets policy |

1, 0 = state has policy, time period before policy in effect |

|

and in time period after |

1, 1 = state has policy, time period after policy in effect |

|

policy in effect |

|

|

Empirical models

State level data

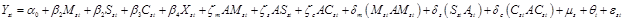

The empirical model used to examine the effect of the policies on state obesity rates while conditioning on state and year fixed effects was:

For this empirical model,  is the dependent variable, percentage rate of adult obesity in a particular state and year;

is the dependent variable, percentage rate of adult obesity in a particular state and year;  is a dummy variable equal to 1 if states in year t had a menu-labeling law and equal to 0 otherwise;

is a dummy variable equal to 1 if states in year t had a menu-labeling law and equal to 0 otherwise;  is a dummy variable equal to 1 if states in year t had a snack tax law and equal to 0 otherwise;

is a dummy variable equal to 1 if states in year t had a snack tax law and equal to 0 otherwise;  is a dummy variable equal to 1 if states in year t had a Complete Streets policy and equal to 0 otherwise.

is a dummy variable equal to 1 if states in year t had a Complete Streets policy and equal to 0 otherwise.  is a vector of state-level control variables including age (age), gender (G), race (R), percentage of individual’s with health coverage (HS), percentage tobacco users (T), percentage of adults with HS degree or GED (HS), and state controls for state population (POP), per capita income (PCI) and employment to population ratio (Emppop).

is a vector of state-level control variables including age (age), gender (G), race (R), percentage of individual’s with health coverage (HS), percentage tobacco users (T), percentage of adults with HS degree or GED (HS), and state controls for state population (POP), per capita income (PCI) and employment to population ratio (Emppop).  is a dummy variable equal to 1 if time period is after menu labeling law put in effect;

is a dummy variable equal to 1 if time period is after menu labeling law put in effect;  is a dummy variable equal to 1 if time period is after snack tax law put in effect;

is a dummy variable equal to 1 if time period is after snack tax law put in effect;  is a dummy variable equal to 1 if time period is after Complete Streets policy is put in effect.

is a dummy variable equal to 1 if time period is after Complete Streets policy is put in effect.  ,

,  and

and  are interaction terms representing if a state has a policy (1) or does not have a policy (0) and if in time period before (0) or after (1) the policy is put into effect. State fixed effects are represented by

are interaction terms representing if a state has a policy (1) or does not have a policy (0) and if in time period before (0) or after (1) the policy is put into effect. State fixed effects are represented by , year fixed effects are represented by

, year fixed effects are represented by  and

and  is the disturbance term. The state fixed effects were used to account for the influence of any time-invariant unmeasured factors that would cause states to have different rates of adult obesity. The year fixed effects were used to capture changes in adult obesity rates common to all states over time.

is the disturbance term. The state fixed effects were used to account for the influence of any time-invariant unmeasured factors that would cause states to have different rates of adult obesity. The year fixed effects were used to capture changes in adult obesity rates common to all states over time.

Individual level data

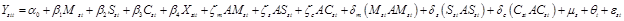

The empirical model used to examine the effect of the anti-obesity policies on individual BMI while conditioning on state and year fixed effects was:

For this model,  is the dependent variable, BMI for a individual in a particular state and year;

is the dependent variable, BMI for a individual in a particular state and year;  is a dummy variable equal to 1 if states in year t had a menu-labeling law and equal to 0 otherwise;

is a dummy variable equal to 1 if states in year t had a menu-labeling law and equal to 0 otherwise;  is a dummy variable equal to 1 if states in year t had a snack tax law and equal to 0 otherwise;

is a dummy variable equal to 1 if states in year t had a snack tax law and equal to 0 otherwise;  is a dummy variable equal to 1 if states in year t had a Complete Streets policy and equal to 0 otherwise.

is a dummy variable equal to 1 if states in year t had a Complete Streets policy and equal to 0 otherwise.  is a vector of individual level control variables including age (age), gender (G), race (R), health coverage (HC), tobacco use (T), education level (Ed), and income level (I).

is a vector of individual level control variables including age (age), gender (G), race (R), health coverage (HC), tobacco use (T), education level (Ed), and income level (I).  is a dummy variable equal to 1 if time period is after menu labeling law put in effect;

is a dummy variable equal to 1 if time period is after menu labeling law put in effect;  is a dummy variable equal to 1 if time period is after snack tax law put in effect;

is a dummy variable equal to 1 if time period is after snack tax law put in effect;  is a dummy variable equal to 1 if time period is after Complete Streets policy is put in effect.

is a dummy variable equal to 1 if time period is after Complete Streets policy is put in effect.  ,

,  and

and  are interaction terms representing if a state has a policy (1) or does not have a policy (0) and if in time period before (0) or after (1) the policy is put into effect. State fixed effects are represented by

are interaction terms representing if a state has a policy (1) or does not have a policy (0) and if in time period before (0) or after (1) the policy is put into effect. State fixed effects are represented by  , year fixed effects are represented by

, year fixed effects are represented by  and

and  is the disturbance term.

is the disturbance term.

Group level data

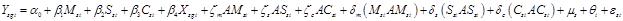

The empirical model used to examine the effect of the policies on BMI at the group level while conditioning on state and year fixed effects was:

For this model,  is the dependent variable, average BMI for group;

is the dependent variable, average BMI for group;  is a dummy variable equal to 1 if states in year t had a menu-labeling law and equal to 0 otherwise;

is a dummy variable equal to 1 if states in year t had a menu-labeling law and equal to 0 otherwise;  is a dummy variable equal to 1 if states in year t had a snack tax law and equal to 0 otherwise;

is a dummy variable equal to 1 if states in year t had a snack tax law and equal to 0 otherwise;  is a dummy variable equal to 1 if states in year t had a Complete Streets policy and equal to 0 otherwise.

is a dummy variable equal to 1 if states in year t had a Complete Streets policy and equal to 0 otherwise.  is a vector of group level control variables including mean age for group (age), gender of group (G), race of group (R), health coverage for group (HS), tobacco use for group (T), education level for group (Ed) and income level for group (I).

is a vector of group level control variables including mean age for group (age), gender of group (G), race of group (R), health coverage for group (HS), tobacco use for group (T), education level for group (Ed) and income level for group (I).  is a dummy variable equal to 1 if time period is after menu labeling law put in effect;

is a dummy variable equal to 1 if time period is after menu labeling law put in effect;  is a dummy variable equal to 1 if time period is after snack tax law put in effect;

is a dummy variable equal to 1 if time period is after snack tax law put in effect;  is a dummy variable equal to 1 if time period is after Complete Streets policy is put in effect.

is a dummy variable equal to 1 if time period is after Complete Streets policy is put in effect.  ,

,  and

and  are interaction terms representing if a state has a policy (1) or does not have a policy (0) and if in time period before (0) or after (1) the policy is put into effect. State fixed effects are represented by

are interaction terms representing if a state has a policy (1) or does not have a policy (0) and if in time period before (0) or after (1) the policy is put into effect. State fixed effects are represented by  , year fixed effects are represented by

, year fixed effects are represented by  and

and  is the disturbance term.

is the disturbance term.

Analysis

Regression analysis was used to generate t-statistics to evaluate the impact of the anti-obesity policies on rates of adult obesity by state and to determine their effect on individual and group BMI. The state, individual and group level data were all analyzed with an empirical that included state and year fixed effects. For each model, the estimates of the laws’ effects were determined by t-statistics.

Robustness checks

To account for variances in the application of anti-obesity policy between states and to verify the validity of the models described above, additional regression analyzes were conducted.

Several states have enacted more than one anti-obesity policy during the 16-year time period. It is possible for the magnitude of effect to vary between states with a single policy versus states with more than one policy. Having multiple anti-obesity policies might generate a magnitude of effect beyond what a single anti-obesity policy would be capable of generating. It would be reasonable to expect menu labeling and snack tax policy would have a positive synergistic effect on reducing obesity rates. By having both policies, consumers are provided the tools necessary to make educated food-purchasing decisions at the same time unhealthy foods are being sold at a higher cost. The co-existence of a menu labeling and Complete Streets policy might also have a compounding positive effect. With both policies in place, a state has a policy designed to reduce caloric intake while simultaneously having a policy intended to increase caloric expenditure.

To assess the impact of a state having more than one law in place during the time frame of 1995 to 2011, additional regressions using model 1, state and year fixed effects, with a dummy variable for multiple laws was generated. The dummy variable, multiple laws, was coded 0 if a state did not have a policy at any point in time, 1 if a state only had 1 policy during the 16-year time period, 2 if the policy had 2 policies over the time period and 3 for three policies in the 16 years.

Since, the tax rates varied for states with snack tax policy, an additional regression model was generated to determine if the percentage rate of a tax is influential on the effectiveness of a snack tax policy.

Results

State level analysis

State descriptive statistics: The descriptive statistics for the state level dataset, including means and standard deviations for the key variables, are shown in Table 2. A total of 848 observations were included in the state level dataset inclusive of 50 states and the District of Columbia over a 16 year time period. The first year of data was from 1995, the final year of data from 2011 and the mean year was 2003.

Table 2. Descriptive Statistics of Aggregated State Level Data

Descriptive Statistics (N= 848) |

Variable |

Mean (SD) |

Obese (BMI ≥ 30) |

22.35 (0.17) |

Age |

|

Age 18-24 |

12.6 (0.06) |

Age 25-34 |

18.3 (0.07) |

Age 35-44 |

20.1 (0.07) |

Age 45-54 |

18.5 (0.05) |

Age 55-64 |

13.2 (0.06) |

Age 65+ |

17.3 (0.08) |

Male |

48.4 (0.03) |

Female |

51.6 (0.04) |

Race |

|

Caucasian |

77.7 (0.52) |

African American |

8.8 (0.35) |

Hispanic |

7.5 (0.29) |

Has any kind of health insurance coverage |

79.2 (0.68) |

Currently uses tobacco |

21.7 (0.12) |

Has a high school degree or GED |

31.5 (0.15) |

State population |

5,704,831 (215756.7) |

Sate per capita income |

31, 980.55 (276.8) |

State employment to population ratio |

.60 (0.00) |

The mean percentage rate of obese adults, individuals with a BMI ≥ 30 kg/m2, across all states for the time period of 1995 to 2011 was 22.35% (SD=0.17). The state with the lowest rate of obesity over the time period was Colorado with an adult obesity rate of 10.1% in 1995. The state with the highest rate of adult obesity, during the time panel, was Mississippi at 35.4% in 2009.

In the aggregated state dataset, adults between the ages of 35 and 44 represented the largest portion of the sample at 20.1% and adults between the ages of 18 and 24 comprised the smallest portion of the sample at 12.6%. A greater portion of the sample population was female (51.6%) than male (48.4%). Regarding racial composition, Non-Hispanic Whites represented the largest portion of the sample population (77.7%) followed by African Americans (8.8%) and Hispanics (7.5%).

The majority of the sample had some type of health insurance coverage (79.2%). Across states, the mean rate of smokers was 21.7% and 31.5% of the sample had a high school education or GED. The average population size of the states included in the sample was 5,704,831. The average per capita income for a state in the dataset was 31,980.55 and the average employment to population ratio was 0.60.

State regression analysis: Based on the empirical model, all three policies (menu labeling, snack taxes, Complete Streets) are associated with a reduction in state percentage rate of adult obesity (Table 3). However, the size of the effect varies between the three policies, with the beta coefficient as -0.28 for Complete Streets, -0.53 for Snack taxes and -0.85 for menu labeling. These values indicate the anti-obesity policies are associated with a 0.28% to 0.85% reduction in rates of state level adult obesity. Each policy has a less than 1% effect on lowering rates of adult obesity. According to the implemented empirical model, snack tax policy is statistically significance at p < 0.05 [p=0.02] and menu labeling policy is marginally significant at p < 0.10 [p=0.09].

Table 3. Regression Estimates for State Level Data

|

β |

SE |

|

Menu Labeling |

-0.85 |

(0.50) |

* |

Snack Tax |

-0.53 |

(0.23) |

** |

Complete Streets |

-0.28 |

(0.24) |

|

Sample |

848 |

|

|

R-squared |

0.95 |

|

|

Notes: Table reports regression coefficients with standard errors. Errors are clustered at the state level. * = p ≤ 0.10, ** = p ≤ 0.05

Individual level analysis

Individual descriptive statistics: The descriptive statistics for the individual level data are shown in Table 4. A total of 1,274,465 observations were included in the individual level dataset inclusive of 51 states (50 states and the District of Columbia) over a 16 year time period from 1995 to 2011.

Table 4. Descriptive Statistics for Individual Level Data

Descriptive Statistics (N=1,274,465)

Variable |

Mean (SD)/Frequency |

BMI |

27.2 (0.00) |

Age |

51.2 (17.1) |

Male |

41.35 |

Female |

58.65 |

Race |

|

Caucasian |

74.25 |

African American |

7.59 |

Hispanic |

18.15 |

Has Healthcare Coverage |

88.48 |

Smokes |

48.33 |

Education |

|

No school |

0.13 |

Grade 1-8 |

2.86 |

Grade 9-11 |

6.31 |

High School Grad |

30.12 |

College 1-3 |

27.29 |

College Grad |

33.29 |

State Population |

6,950,720 (3810) |

Income |

|

<10,000 |

5.53 |

10,000–14,999 |

6.18 |

15,000-19,999 |

8.16 |

20,000-24,999 |

10.23 |

25,000-34,999 |

13.95 |

35,000-49,999 |

17.00 |

50,000-74,999 |

16.54 |

>75,000 |

22.41 |

The mean BMI for individuals in the sample during the time period was 27.2, which, represents the CDC BMI category of overweight. The average age of an individual in the sample was 51.2 years. The majority of individuals were female (58.65%) versus male (41.35%). The sample was predominately of individuals classified as Non-Hispanic White (74.25%), followed by persons racially identified as Hispanic (18.15%) and African American (7.59%).

A significant portion of individuals had some type of healthcare coverage (88.48%). Individuals who had smoked at least 100 cigarettes in their lifetime represented 48.33% of the sample. Regarding education, the majority of individuals were college graduates (33.29%) followed by individuals with some college (27.29%), high school graduate (30.12%), some high school education (6.31%), grade school education (2.86%) and no education (0.13%).

The lowest income group, <$10,000, was represented by 5.53% of the sample and the highest income group >$75,000 comprised 22.41% of the sample. The average state population was 6,950,720.

Individual regression analysis: Results of the individual level data analysis are presented in Table 5. For the individual regression analysis, each of the policies is associated with a reduction in BMI value, although, the magnitude is negligible. The magnitude of effect is less than one for each policy and ranges from a 0.04 to 0.16 decrease in BMI value [menu labeling β=-0.16, snack tax β=-0.04, Complete Streets β=-0.08].

Table 5. Regression Estimates for Individual Level Data

|

β |

SE |

Menu Labeling |

-0.16 |

(0.07) * |

Snack Tax |

-0.04 |

(0.04) |

Complete Streets |

-0.08 |

(0.05) |

Sample |

1,274,465 |

R-squared |

0.06 |

|

Notes: Table reports regression coefficients with standard errors. Errors are clustered at the state level. * = p ≤ 0.05, ** = p ≤ 0.001.

The menu labeling policy was the only policy statistically significant at the 5 percent level [menu labeling p=0.05]. Although statistically significant, the question of whether the magnitude of this effect is meaningful is questionable. A reduction in BMI of 0.16 is not sufficient to alter an individual’s CDC BMI classification from one category to another. Specifically, it would not change an individual’s status from obese to overweight.

Group level analysis: Since, rates of adult obesity vary by race, age, income, education and gender, the effects of the anti-obesity policies may vary by these socio-demographic characteristics. The following section provides information on the analysis of the impact of each policy by group.

Race: Results of the racial group data analysis are presented in Table 6. An analysis of racial groups, identifies for Caucasians, menu labeling and Complete Streets policy are associated with a reduction in BMI while snack tax policy has a negligible effect. The magnitude of effect for menu labeling and Complete Streets is limited [menu labeling β=0.44, Complete Streets β=0.07). None of the three policies are statistically significant.

Table 6. Regression Analysis of Racial Groups

|

Menu Labeling |

Snack Tax |

Complete |

Sample |

R-Squared |

|

|

|

|

|

Streets |

(N) |

|

|

|

|

|

|

|

|

|

|

|

β |

SE |

β |

SE |

β |

SE |

|

|

Non-Hispanic |

-0.44 |

(0.54) |

0.32 |

(0.18) * |

-0.07 |

(0.24) |

863 |

0.63 |

White |

|

|

|

|

|

|

|

|

African American |

1.02 |

(0.59) * |

0.17 |

(0.41) |

0.19 |

(0.40) |

816 |

0.32 |

Hispanic |

0.05 |

(0.17) |

-0.11 |

(0.08) |

-0.05 |

(0.14) |

865 |

0.70 |

Notes: Table reports regression coefficients with standard errors. Errors are clustered at the state level. * = p ≤ 0.10

For African Americans, none of the policies are associated with a reduction in BMI value. Rather, each policy has an associated increase in BMI ranging from an increase of 0.17 to 1.0 [menu labeling β=1.0, snack tax β=0.17, Complete Streets β=0.19]. However, only menu labeling is statistically significant. The magnitude of effect for each of the policies is negligible.

For Hispanics, snack tax and Complete Streets policy are associated with a reduction in BMI and menu labeling has a negligible increase. The magnitude of effect ranges from -0.11 to +0.05 [snack taxes β=0.11, Complete Streets β=0.05, menu labeling β=0.06]. None of the three policies have a statistically significant effect on the Hispanic subpopulation.

Age: Results of the age group data analysis are presented in Table 7. For the age subgroups, all three of the anti-obesity policies are associated with a reduction in BMI. The magnitude varies by age group and type of policy. All of the magnitudes were less than one with menu labeling having the largest beta coefficient at -0.29 for age group 35 to 44.

Table 7. Regression Analysis of Age Groups

|

Menu Labeling |

Snack Tax |

Complete |

Sample |

R-Squared |

|

|

|

|

|

|

Streets |

|

(N) |

|

|

|

|

|

|

|

|

|

|

|

|

β |

SE |

|

β |

SE |

β |

SE |

|

|

Age Group |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18-24 |

-0.15 |

0.12 |

|

-0.15 |

0.06 |

-0.06 |

0.08 |

865 |

0.77 |

|

|

|

|

|

|

|

|

|

|

25-34 |

-0.07 |

0.11 |

|

0.02 |

0.05 |

-0.01 |

0.05 |

864 |

0.92 |

|

|

|

|

|

|

|

|

|

|

35-44 |

-0.29 |

0.11 |

** |

-0.07 |

0.05 |

-0.03 |

0.07 |

865 |

0.93 |

|

|

|

|

|

|

|

|

|

|

45-54 |

-0.13 |

0.05 |

* |

-0.02 |

0.06 |

-0.01 |

0.06 |

865 |

0.91 |

|

|

|

|

|

|

|

|

|

|

55-64 |

-0.26 |

0.10 |

** |

0.03 |

0.05 |

-0.12 |

0.06 |

865 |

0.87 |

|

|

|

|

|

|

|

|

|

|

65-99 |

-0.10 |

0.07 |

|

-0.06 |

0.04 |

0.02 |

0.05 |

865 |

0.91 |

|

|

|

|

|

|

|

|

|

|

Notes: Table reports regression coefficients with standard errors. Errors are clustered at the state level. * = p ≤ 0.05, ** = p ≤ 0.01

Snack tax and Complete Streets policy were not statistically significant for any age group. Menu labeling was statistically significant at p < 0.05 for three age groups, (ages 35 to 44 [p=0.01], ages 45-54 [p=0.02], ages 55-64 [p=0.01]), although, the beta coefficients were of limited magnitude ranging from -0.13 to -0.29.

Income: Results of the income group data analysis are presented in Table 8. The analysis of income groups revealed menu labeling policy was associated with a reduction in BMI and this reduction was statistically significant for individuals with income > than 35,000. For individuals in income group 35,000 to 49,999, menu labeling policy was statistically significant at p < 0.001 [p=0.001]. For individuals in income group 50,000 to 74,999 and > 75,000, menu labeling was statistically significant at p > 0.05 [p=0.02 for both groups]. The largest magnitude in BMI reduction was for income group 35,000 to 49,999, followed by income group 50,000 to 74,999 and income group > 75,000. Despite the presence of statistical significance for income groups > 35,000, the association between menu labeling policy and BMI is of insignificant magnitude with beta coefficients less than one (β=0 to β=-0.28) for all income groups.

For snack tax and Complete Streets policy, neither policy was statistically significant for any income group. For snack tax policy, the effect declines as rate of income increases which, suggests higher SES groups are less price elastic. In addition, the beta coefficients for snack taxes, ranging from 0 to -0.9 and the beta coefficients for Complete Streets, ranging from -0.1 to -0.06, are of insignificant magnitude.

Table 8. Regression Analysis of Income Groups

|

Menu Labeling |

Snack Tax |

Complete |

Sample |

R-Squared |

|

|

|

|

|

|

Streets |

|

(N) |

|

|

|

|

|

|

|

|

|

|

|

|

β |

SE |

|

β |

SE |

β |

SE |

|

|

<10,000 |

-0.28 |

0.23 |

|

0.00 |

0.07 |

-0.01 |

0.15 |

863 |

0.78 |

10,000-14,999 |

-0.17 |

0.15 |

|

0.00 |

0.08 |

-0.10 |

0.11 |

864 |

0.80 |

15,000-19,999 |

-0.20 |

0.14 |

|

-0.08 |

0.09 |

-0.03 |

0.08 |

865 |

0.84 |

20,000-24,999 |

-0.00 |

0.13 |

|

-0.09 |

0.08 |

-0.02 |

0.10 |

865 |

0.88 |

25,000-34,999 |

-0.10 |

0.09 |

|

-0.06 |

0.05 |

-0.06 |

0.07 |

865 |

0.90 |

35,000-49,999 |

-0.23 |

0.06 |

** |

-0.01 |

0.05 |

-0.02 |

0.06 |

865 |

0.91 |

50,000-74,999 |

-0.23 |

0.09 |

* |

-0.04 |

0.06 |

-0.02 |

0.06 |

865 |

0.92 |

>75,000 |

-0.14 |

0.06 |

* |

0.01 |

0.05 |

-0.06 |

0.05 |

865 |

0.90 |

|

|

|

|

|

|

|

|

|

|

Notes: Table reports regression coefficients with standard errors. Errors are clustered at the state level. * = p ≤ 0.05, ** = p ≤ 0.001.

Education: Results of the income group data analysis are presented in Table 9. With regards to educational groups, snack tax policy is associated with a reduction in BMI for all educational groups with beta coefficients ranging from -0.02 to -0.42 with the exception of a negligible effect for college graduates [β=0.00]. Menu labeling policy is associated with a reduction in BMI for all educational groups [β=-0.03 to β=-1.32] with a negligible effect for education group grades 1-8 [β=0.02]. Complete Streets policy is associated with a reduction in BMI for all educational groups [β=-0.05 to -0.06] with the exception of educational groups; no school, grades 1-8 and college graduates [β=0 to 1.33].

Table 9. Regression Analysis of Education Groups

|

Menu Labeling |

Snack Tax |

Complete |

Sample |

R-Squared |

|

|

|

|

|

Streets |

|

(N) |

|

|

|

|

|

|

|

|

|

|

|

β |

SE |

β |

SE |

β |

SE |

|

|

No school |

-1.22 |

0.78 |

-0.42 |

0.79 |

1.33 |

0.87 |

572 |

0.22 |

Grades 1-8 |

0.02 |

0.19 |

-0.12 |

0.90 |

0.05 |

0.13 |

856 |

0.55 |

Grades 9-11 |

-0.32 |

0.11** |

-0.15 |

0.07* |

-0.06 |

0.10 |

865 |

0.77 |

HS Grad |

-0.03 |

0.07 |

-0.08 |

0.38* |

-0.06 |

0.04 |

865 |

0.95 |

College 1-3 |

-0.13 |

0.09 |

-0.02 |

0.03 |

-0.05 |

0.04 |

865 |

0.95 |

College Grad |

-0.18 |

0.07** |

0.04 |

0.05 |

0.00 |

0.05 |

865 |

0.94 |

|

|

|

|

|

|

|

|

|

Notes: Table reports regression coefficients with standard errors. Errors are clustered at the state level. * = p ≤ 0.05, ** = p ≤ 0.01

Menu labeling is statistically significant for education groups, grades 9-11, and for the college graduate subgroup at p < 0.01 [grades 9-11 p=0.01, college graduate p=0.01]. Snack tax policy is significant for the some high school subgroup and high school graduate subgroup [p=0.04, p=0.04, respectively]. Even though menu labeling and snack tax policy are statistically significant, the magnitude of effect for both policies is too small to generate a meaningful change in BMI as both have beta coefficients of less than zero. Complete Streets policy is not statistically significant for any education subgroup.

Gender: Results of the income group data analysis are presented in Table 10. For gender, all of the policies are associated with a reduction in BMI for both genders except snack tax policy has a negligible effect on males. Menu labeling is associated with the largest decrease in BMI for both genders with a beta coefficient of -0.14 (females) and -0.07 (males). For both genders, none of the anti-obesity policies have a statistically significant effect at the p < 0.05. Menu labeling is significant at the 10% level for females [p=0.08].

Table 10. Regression Analysis by Gender

|

Menu Labeling |

Snack Tax |

Complete |

Sample |

R-squared |

|

|

|

|

|

Streets |

|

(N) |

|

|

|

|

|

|

|

|

|

|

|

β |

SE |

β |

SE |

β |

SE |

|

|

Female |

-0.14 |

0.08 * |

-0.04 |

0.36 |

-0.07 |

0.06 |

815 |

0.96 |

|

|

|

|

|

|

|

|

|

Male |

-0.07 |

0.06 |

0.02 |

0.03 |

-0.02 |

0.03 |

815 |

0.95 |

|

|

|

|

|

|

|

|

|

Notes: Table reports regression coefficients with standard errors. Errors are clustered at the state level. * = p ≤ 0.10

Robustness checks

Multiple policies: Additional regressions were conducted to understand the impact of variances in implementation of the anti-obesity policies between states and to verify validity of the outcome data obtained using the empirical models outlined in the methods section. Outcome data is presented on the impact of a multiple policy state as well as the impact of varying tax rates by state. See table 11 for results.

Table 11. Regression Analysis of Number of Laws Per State

|

One Policy |

Two Policies |

Three Policies |

|

|

|

|

|

|

|

|

β |

SE |

β |

SE |

β |

SE |

Menu Labeling |

Omitted |

-0.17 |

0.07 * |

0.50 |

0.03 * |

|

|

|

|

|

|

|

Snack Tax |

0.01 |

0.15 |

-0.10 |

0.04 * |

-0.18 |

0.15 |

|

|

|

|

|

|

|

Complete Streets |

-0.05 |

0.18 |

-0.05 |

0.06 |

-0.83 |

0.03 * |

|

|

|

|

Sample (N) |

360,135 |

347, 865 |

101,724 |

|

|

|

|

|

|

|

R-Squared |

0.96 |

|

0.97 |

|

1.0 |

|

|

|

|

|

|

|

|

Notes: Table reports regression coefficients with standard errors. Errors are clustered at the state level. * = p ≤ 0.05

Using the individual level panel data set, the regression for a single policy state, indicates snack tax policy has a negligible effect on BMI with a beta coefficient of 0.01. Complete Streets policy is associated with an insignificant reduction in BMI with a beta coefficient of -0.06. Neither policy is statistically significant. Since menu labeling has only been adopted by states with other anti-obesity policies, menu labeling was dropped from this regression because of collinearity.

The regression for states with at least two policies shows all three policies were associated with a reduction in BMI. Menu labeling had the largest magnitude of effect; yet, the effect was still less than one [menu labeling β=-0.18, snack tax β=-0.10, Complete Streets β=-0.06]. Both menu labeling and snack tax policy were statistically significant at p < 0.05 [menu labeling p=0.02, snack tax p=0.02].

For the dummy variable, multiple laws equal to three, both snack tax and Complete Streets policy were associated with a reduction in BMI [β= -0.18, β= -0.83] while menu labeling had a 0.5 associated increase in BMI. Both menu labeling and Complete Streets policy were statistically significant.

Overall, the magnitude of effect increased for each policy as the number of policies increased. However, regardless of the number of policies a state had, the magnitudes of effect were less than one.

Varying tax rate: For states with a snack tax policy, the percentage rate of tax varied from 1.0% to 7.0%. This range in tax rate could influence the effect of the snack tax on altering rates of adult obesity. To evaluate the effect of percentage tax rate, a regression was run using the aggregated state level data and model 1 [n=852]. The results of this regression indicated tax rate is associated with a reduction in state obesity rates [β= -0.10] and this association is statistically significant at p < 0.05 [p=0.04, R-squared 0.95]. The outcome of this regression model suggests the magnitude of a tax rate is influential on the effectiveness of a snack tax policy.

Discussion

The results obtained from this project have significant implications for the public policy agenda. Over the past few years, several state legislatures have enacted laws in an effort to curtail rising rates of adult obesity. However, the effectiveness of these policies on slowing rates of adult obesity has yet to be evaluated. Considering the associated costs of obesity, as well as, the costs of implementing anti-obesity policies, it is imperative the effectiveness of anti-obesity legislation be determined.

Menu labeling

Menu labeling demonstrated the largest magnitude of effect among the three policies; however, the benefit of this policy from a real world perspective is unclear. At the state level, menu labeling was associated with a less than 1% reduction in rates of adult obesity. From a policy and fiscal perspective, the question is if this reduction in obesity rates is significant enough to alter the associated costs of obesity.

At the individual level this policy was associated with a reduction in BMI of less than one. Research indicates the negative health consequences stemming from obesity are reduced with a five percent decrease in body weight [47,48]. According to the CDC, the height and weight for the average man is 63.8 inches, 166.2 pounds and the height and weight for the average women is 63.8 inches and 166.2 pounds [49]. For the average man and women to lose 5% body weight they would need to lose 9.78 and 8.31 pounds respectively. In terms of BMI value, the average person would need to decrease BMI by 1.4 for positive health benefits. This BMI change is larger than the reduction seen with the menu labeling policy.

Other state level strategies for addressing adult obesity include benefit coverage for state employees to participate in weight-loss intervention programs [50]. Recent meta-analysis revealed enrollees lose on average between 3 and 7 pounds as a result of 12 month, weight-loss intervention programs [51,52]. However, additional research has shown individuals have a steady regain of weight beginning 6 months after cessation of the weight-loss program with a return to baseline weight by 5.5 years [53]. Considering the modest weight loss seen with these interventions combined with the fact menu labeling can be implemented broadly for long time periods suggests menu labeling might be more worthy of support.

Of the three policies, menu labeling has been in effect for the shortest period of time with the first year of implementation in 2008 and the most recent adoption in 2010. The assessment timeframe for menu labeling was limited and should be factored into the analysis of its effectiveness. Despite having the shortest period in which the law was in effect, menu labeling policy had the greatest magnitude of effect. This suggests it may be reasonable to consider continued support for menu labeling policy at the state level as well as moving forward with FDA negotiations to develop a national menu labeling law. Menu labeling, as currently implemented, is restricted to chain restaurants of 20 or more locations, expansion of this policy to reach a broader range of food vendors might be worthy of consideration by policy makers. Although, the value of the menu labeling law is not overtly clear, any sign of a reversal in the growing obesity trend, a trend that has been unaltered for the past decade, could be seen as a sign of improvement from a public health perspective.

Snack taxes

Snack tax policies had a limited effect at both the state and individual levels with statistical significance limited to the state level analysis. The magnitude of effect, regardless of statistical significance was insignificant. Gelbach et al. (2007) report taxation can be an effective method of moderating individual risk behavior if the tax rate is sufficient to alter consumer habits. The tax rates for this dataset ranged from 1.0% to 7.0% with the majority of states (11 of 21) having a 5-6% tax on snacks. Considering the limited effect existing snack taxes appear to have on slowing adult obesity rates, this evaluation suggests current snack tax rates may not have reached a threshold sufficient to alter consumer food purchasing behaviors. From the analysis on tax rates, I found tax rate was statistically significant. If tax rates were to be higher, a greater magnitude of effect might be found. Based on their analysis of existing research, Mytton, Clarke & Rayner (2012), indicate a tax between 17.5 to 20% would be necessary to see changes in obesity rates. From a historical perspective, there is evidence a higher tax rate can be effective in altering individual behavior choices. Increasing tax rates on cigarettes has been associated with a greater impact on reducing the number of smokers [45].

The availability of substitute food goods must not be discounted when reviewing the relatively limited influence seen with snack tax legislation. As previous studies have shown, the market for high calorie, low nutritional food is expansive [46,56]. Further, the food market is not limited to a simple two-good world of healthy and unhealthy foods. Since snack taxes are not all-inclusive, individuals can substitute taxed foods with other poor quality non-taxed food. This substitution of goods would limit the power of snack taxes to reduce rates of adult obesity and may be a factor in the lack of significance seen with snack tax policy.

Complete streets policy

Complete Streets policies did not have a statistically significant effect on adult obesity rates for both the state and individual level analysis. The magnitude of effect for Complete Streets policy was a less than 1% reduction in percentage of obese adults at the state level and a less than 1 unit decrease in BMI at the individual level. At the outset of this project, the expectation was for Complete Streets policy to have limited benefit. In comparison to snack tax and menu labeling, general reasoning suggests this policy is likely to have the greatest costs and barriers to implementation.

In order for Complete Streets policy to be effective, physical spaces must be built or revamped, both of which require financial support and labor. The passing of Complete Streets legislation does not ensure a state has sufficient budgetary means to build or restructure existing biking and walking paths. Complete Streets policy is also likely to have a greater delay between the time the policy is legislatively approved and the time the recreational space would be usable.

2021 Copyright OAT. All rights reserv

Significance by group

Race: Regarding race, snack taxes had a statistically significant perverse effect on Non-Hispanic Whites while menu labeling had a statistically significant perverse effect for Blacks. None of the three policies had a statistically significant impact on Hispanics. Considering the disparity in growth of obesity within the African American and Hispanic population, the consideration of this differential effect between policies is of value. Policy makers must take into account a single policy may not effectively target all racial groups.

Age: Across age groups, menu labeling was the only policy with a statistically significant effect. Menu labeling was associated with reducing rates of adult obesity for age groups 35-44, 45-54 and 55-64. Research shows obesity is growing most rapidly in adults between the ages of 18-29 [57]. In addition, the fastest growing age group for newly reported cases of type 2 diabetes, a consequence of obesity, is adults aged 30-39 [57]. From a healthcare cost perspective, menu labeling is not capturing a key age group. A policy that affected individuals in their 20’s would have a greater impact in reducing medically related obesity costs, as it would provide the opportunity to alter behaviors before the onset of serious health complications.

The differential effect of menu labeling between older and younger adults may be related to the onset of medical complications. The age group over 35 is likely to have incurred medical intervention for their obesity related symptoms including education on the relationship between health and diet. Whereas, those under the age of 30 may have yet to experience the negative side effects of obesity thus, this age group would be less receptive to menu labeling. These results indicate developing policies effective for younger age groups is necessary.

Income: Menu labeling was associated with a statistically significant reduction in adult obesity rates for those with an income at or above $35,000. This suggests the effectiveness of menu labeling may be dependent on the financial stability of the purchaser. For instance, a high-income individual is likely to have the financial flexibility to make food-purchasing decisions based on nutritional content without regard for price. Whereas, it is probable for an individual with limited income to be restricted to making food-purchasing decisions based upon cost rather than menu labels. The results of this study are consistent with existing research relative to income and food-purchasing behaviors. Specifically, it has been found that low-income families are more conscious of price with their food choices and healthier foods often cost more [58].

Snack taxes did not have a statistically significant effect on reducing adult obesity rates regardless of income. However, the magnitude of effect decreased as income increased. This decline in effect as income rises suggests groups with more substantial income are less influenced by the cost of food; therefore, policies designed to raise the cost of low nutrition foods may have limited impact on obesity rates for higher income groups. Conceptually, this would be similar to the effects observed with cigarette taxes. Studies analyzing the effectiveness of cigarette taxes on tobacco consumption have found higher SES groups are less price elastic than lower SES groups, thus, cigarette taxes have been less effective in decreasing smoking rates in higher income populations [56,59,60]. My results indicate ignoring the role income plays in developing anti-obesity policy would be a naïve approach to addressing the obesity issue. Developing policies targeted at both high and low-income individuals appears to be necessary.

Education: Menu labeling did not have a statistically significant effect on reducing rates of adult obesity for the subgroups with less than a high school education. In order for menu labeling to be effective, an individual needs to have a sufficient educational background to understand the implications of the food labels provided. It is reasonable to assume those with education below high school level would have low health literacy and would not have the necessary skills to evaluate nutritional content when selecting foods. Several studies have identified a relationship between education level and health literacy, with more education being beneficial to health awareness [61,62].

According to data published by the Bureau of Labor Statistics (BLS), lower levels of educational attainment are associated with lower median weekly earnings. Hence, similar to the income subgroup analysis, those with lower levels of education are more likely to be restricted in responding to food labels because of limited income. The results from this project are consistent with prior studies investigating the impact of education and income on diet quality which, found higher household income and education level is equated to a healthier diet [63].

Snack taxes had a statistically significant effect on reducing rates of adult obesity for both the high school graduate group and for the group with some high school education. Considering lower levels of education are often associated with lower income, the constraints of a limited budget might force individuals in these two subgroups to reduce their purchases of taxed snack foods. Overall, the magnitude of effect for snack taxes declined with increasing levels of education. Based on the BLS, individuals with education beyond high school likely have larger incomes than those with a high school education or less. The absence of an effect for higher education groups, suggests current snack tax rates are likely insufficient to require individuals in these subgroups to alter food choices because of cost.

Gender: Although, none of the policies were statistically significant for either sex, the policies did have a different magnitude of effect between males and females for each policy. For women, menu labeling had the largest magnitude of effect. A recent study comparing gender differences for reading food labels found women are more likely to review food labels when making food selection choices [64]. A reduction in female rates of obesity associated with menu labeling would require women to alter their food choices based on nutritional information provided on a menu, and would represent behavior consistent with current literature. My results suggest it may be beneficial to target men and women separately when developing anti-obesity legislation.

Overall, my results from the group analysis suggest a uniform application of anti-obesity policy may inhibit the effectiveness of anti-obesity legislation. A greater emphasis should be placed on diversifying policies. Generating unique policies to target different subgroups would be a more powerful policy strategy.

Limitations

I believed tax rate would influence the effectiveness of a snack tax on reducing rates of obesity; therefore I generated a regression model to analyze states with snack taxes by the size of the tax. This model did not incorporate changes in tax rates for states with a snack tax policy as information on tax rate from year to year was not readily available for the 16 years analyzed in this study. Since, the model does not incorporate changes in tax percentage across year for states with snack taxes; the validity of this regression model is limited. Despite this limitation, the results of the regression model were significant and in the hypothesized direction. The rate of a snack tax is statistically significant; thus, the size of a snack tax will influence how effective the tax is on reducing rates of obesity. Policymakers need to ensure the size of a snack tax is sufficiently high when generating tax-based anti-obesity legislation.

Summary of policy implications

The small magnitude of effect identified on adult obesity rates by the policies analyzed in this study should not be taken as justification to discard the policies outright. Although, the magnitudes were small, the presence of an effect does demonstrate a change and given the timeframe of this study, a positive change should not be ignored. The power of this study is limited in that both menu labeling and Complete Streets policies have been implemented relatively recently in the majority of adopter states and both these policies likely require time to cause global changes in obesity rates.

With the exception of the states with multiple policies, current obesity-related legislation has focused on a single contributing factor such as diet (menu labeling, snack taxes) or exercise (Complete Streets). The findings of this study indicate social policies isolated to a single factor are insignificant in reducing rates of adult obesity. The analysis of multiple policy states revealed a synergistic effect of having more than one policy in place in that the magnitude of effect on limiting rates of adult obesity was larger for states with multiple policies. This study provides further support obesity is not limited to a single causal factor; rather, obesity is the result of a complex mixture of influences and requires an assortment of legislative policies.

Given the heterogeneity in effect by group, it is clear a “one size fits all” approach will not be effective in combating the obesity epidemic. A recent CDC study on childhood obesity hypothesized the recent slowing in the number of obese children is the product of having multiple policies implemented at all levels of government [65]. Based on insight from the battle against childhood obesity and the results of this study on adult obesity, there is good support for attacking the obesity epidemic via a tiered government approach with a broad set of policies. This project has provided preliminary insight into recent legislation; however, continued assessment of these existing policies is necessary to evaluate if they will be more influential with time.

Competing interest

No conflicts of interest financial, non-financial, professional, personal or otherwise to disclose.

References

- Centers for Disease Control and Prevention (2012) Prevalence and trends data, overweight and obesity (BMI). Retrieved from http://apps.nccd.cdc.gov/BRFSS/display.asp?cat=OB&yr=2010&qkey=4409&state=MD

- Wechsler H, McKenna ML, Lee SM, Dietz WH (2004) The role of schools in preventing childhood obesity. The State Education Standard: National Association of State Boards of Education. Retrieved from http://www.cdc.gov/HealthyYouth/physicalactivity/pdf/roleofschools_obesity.pdf

- Wyatt SB, Winters KP, Dubbert PM (2006) Overweight and obesity: prevalence, consequences, and causes of a growing public health problem. Am J Med Sci 331: 166-174. [Crossref]

- Field A, Coakley EH, Must A, Spadano JL, Laird N, et al. (2001) Impact of overweight on the risk of developing common chronic diseases during a 10-year period. Arch Intern Med 161: 1581-1586. [Crossref]

- Reilly JJ, Methven E, McDowell ZC, Hacking B, Alexander D, et al. (2003) Health consequences of obesity. Arch Dis Child 88: 748-752. [Crossref]

- Boardman JD, Saint Onge JM, Rogers RG, Denney JT (2005) Race differentials in obesity: the impact of place. J Health Soc Behav 46: 229-243. [Crossref]

- Trasande L (2010) How much should we invest in preventing childhood obesity? Health Aff (Millwood) 29: 372-378. [Crossref]

- Olshansky SJ, Passaro DJ, Hershow RC, Layden J, Carnes BA, et al. (2005) A potential decline in life expectancy in the United States in the 21st century. N Engl J Med 352: 1138-1145. [Crossref]

- Stein CJ, Colditz GA (2004) The epidemic of obesity. J Clin Endocrinol Metab 89: 2522-2525. [Crossref]

- Goetzel R, Gibson T, Short M, Chu B, Waddell J, et al. (2010) A multi-worksite analysis of the relationships among body mass index, medical utilization, and worker productivity. J Occup Environ Med 52: S52-S58. [Crossref]

- Wang G, Dietz WH (2002) Economic burden of obesity in youths aged 6 to 17 years: 1979-1999. Pediatrics 109: 1-6. [Crossref]

- Hauck K, Hollingsworth B (2008) Do obese patients stay longer in hospital? Estimating the health care costs of obesity. Center for Health Economics.

- Finkelstein EA, Trogdon JG, Cohen JW, Dietz W (2009) Annual medical spending attributable to obesity: payer and service specific estimates. Health Affairs 28: 822-831. [Crossref]

- Beydoun MA, Wang Y (2009) Gender-ethnic disparity in BMI and waist circumference distribution shifts in US adults. Obesity (Silver Spring) 17: 169-176. [Crossref]

- Finkelstein EA, DiBonaventura Md, Burgess SM, Hale BC (2010) The costs of obesity in the workplace. J Occup Environ Med 52: 971-976. [Crossref]

- Ricci JA, Chee E (2005) Lost productive time associated with excess weight in the U.S. Workforce. J Occup Environ Med 47: 1227-1234. [Crossref]

- Durden ED, Huse D, Ben-Joseph R, Chu BC (2008) Economic costs of obesity to self-insured employers. J Occup Environ Med 50: 991-997. [Crossref]

- Robert Wood Johnson Foundation (RWJF) (2009) F as in Fat: How obesity policies are failing in America.

- Delormier T, Frohlich KL, Potvin L (2009) Food and eating as social practice-understanding eating patterns as social phenomena and implications for public health. Sociology of Health & Illness 31: 215-228. [Crossref]

- Sallis JF, Bauman A, Pratt M (1998) Environmental and policy interventions to promote physical activity. Am J Prev Med 15: 379-397. [Crossref]

- Stokols D (1996) Translating social ecological theory into guidelines for community health promotion. Am J Health Promot 10: 282-298. [Crossref]

- Battle EK, Brownell KD (1996) Confronting a rising tide of eating disorders and obesity: treatment vs. prevention and policy. Addict Behav 21: 755-765. [Crossref]

- Beydoun MA, Wang Y (2009) Gender-ethnic disparity in BMI and waist circumference distribution shifts in US adults. Obesity (Silver Spring) 17: 169-176. [Crossref]

- Brownell KD, Wadden TA (1992) Etiology and treatment of obesity: understanding a serious, prevalent, and refractory disorder. J Consult Clin Psychol 60: 505-517. [Crossref]

- Jeffery RW (1989) Risk behaviors and health. Contrasting individual and population perspectives. Am Psychol 44: 1194-1202. [Crossref]

- Fitzgerald N, Spaccarotella K (2009) Barriers to healthy lifestyle: From individuals to public policy – An ecological perspective. Journal of Extension 47: 1.

- Hamre R, Kuester S, Renaud J, Williams-Piehota P, Franco E, et al. (2006) Improving nutrition, physical activity and obesity prevention: Performance report of the Nutrition and Physical Activity Program to prevent obesity and other chronic diseases: July 1 through December 31, 2005. Washington, DC: U.S. Government Printing Office.

- Sallis JF, Bauman A, Pratt M (1998) Environmental and policy interventions to promote physical activity. Am J Prev Med 15: 379-397. [Crossref]

- Kumanyika S, Obarzaneck E, Stettler N, Bell R, Field AE, et al. (2008) Population-based prevention of obesity: The need for comprehensive promotion of healthful eating, physical activity, and energy balance: A scientific statement from American Heart Association Council on epidemiology and prevention, interdisciplinary committee for prevention. Circulation 118: 428-464. [Crossref]

- Quinn LA, Thompson SJ, Ott MK (2005) Application of the social ecological model in folic acid public health initiatives. J Obstet Gynecol Neonatal Nurs 34: 672-681. [Crossref]

- Booth KM, Pinkston MM, Poston WS (2005) Obesity and the built environment. J Am Diet Assoc 105: S110-117. [Crossref]

- French SA, Story M, Jeffery RW (2001) Environmental influences on eating and physical activity. Annu Rev Public Health 22: 309-335. [Crossref]

- Handy S, Clifton K (2007) Planning and the built environment: implications for obesity prevention. In: Kumanyika S, Brownson RC (Eds.), Handbook of obesity prevention: A resource for health professionals (pp. 167-188). New York: Springer.

- Hill JO, Wyatt HR, Reed GW, Peters JC (2003) Obesity and the environment: where do we go from here? Science 299: 853-857. [Crossref]

- Boardman JD, Saint Onge JM, Rogers RG, Denney JT (2005) Race differentials in obesity: the impact of place. J Health Soc Behav 46: 229-243. [Crossref]

- Leeman J, Sommers J, Vu M, Jernigan J, Thompson D, et al. (2012) An evaluation framework for obesity prevention policy interventions. Preventing Chronic Disease: Public Health Research, Practice, and Policy, 9: 110322.

- National Conference of State Legislatures (2013) Trans fat and menu labeling legislation.

- Bridging The Gap (2011) State sales taxes on soda and snack foods.